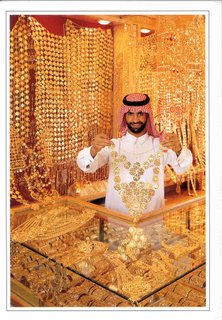

Gold Demand Rises 13% in Saudi Arabia

Arab News - 13/03/2006

JEDDAH, 13 March 2006 — Gold demand increased by 13 percent in Saudi Arabia, while it rose just five percent worldwide in 2005.

In Saudi Arabia, which represents a major market in the region, gold jewelry demand rose by 12 percent during the year compared to 2004, and by 13 percent in terms of both gold jewelry and retail investment sectors, according to the annual review of the regional office of World Gold Council (WGC) in Dubai.

This demand increase is due to the Kingdom's strong economy and the high spend capability. Also, it is expected that the demand will continue to grow similarly in 2006, especially in the context of the biggest budget ever announced by the Kingdom in addition to the increase of marketing activities by large scale gold jewelry manufactures and the WGC across the region.

The increase in gold demand prevailed in the Kingdom's neighboring Gulf countries including Turkey and Egypt. In the UAE, the total percentage of gold demand in 2005 remained positive to reach eight percent in spite of the small decrease in sales during the Q4 of the same year.

As for the other Gulf states like Kuwait, Bahrain, Qatar and Oman, the total increase in demand reached five percent. This increase is also due to high oil prices and strong economy conditions in those countries as well as tourism, especially in UAE, in addition to the increase of marketing activities which were put forward by gold jewelers and the WGC, such as Dubai Shopping Festival, Dubai Summer Surprises, gold festivals and gold jewelry exhibitions in Kuwait and Bahrain in cooperation with several official sectors, such as Dubai government, Gold & Jewelry Committee in Dubai, Dubai Metals and Commodities Center, Ministry of Commerce and Industry in Kuwait, tourism sector in the Ministry of Information in Kuwait etc. Likewise, the growth remained on the rise in Turkey, for the third year in succession, and in Egypt to reach an extra seven percent in Turkey and four percent in Egypt.

Worldwide, the demand has increased on gold jewelry by five percent in 2005 compared to 2004 to reach 2,736 tons. Likewise, demand on gold for industrial use has also increased by two percent to reach 419 tons. The demand on gold for investment has reached 600 tons with an increase of 26 percent for 2005.

According to the figures compiled by Gold Fields Mineral Services Ltd. for the WGC in London for Q4 as well as the whole year of 2005, a remarkable demand increase has been noted for the investment sector, which reached about 200 tons in Q4 of 2005. On the other hand, the gold retail market was affected negatively in Q4 due to the upward surge in the world gold price that resulted from the investment inflows. Selling gold for profit was the trend. In spite of this, the demand in Q4 was strong enough to absorb the extra 10 percent increase in supply and the 12 percent increase in the price. "The region's gold markets are getting used to the price of $500 per ounce, which is due to the confidence of consumers in gold, whether it is for investment and saving or for gold jewelry in modern life," Moaz Barakat, managing director of the WGC for the Middle East, Turkey and Pakistan said.

"In addition to the high world oil prices and the flow of liquidity, a weak dollar and an uncertain geopolitical situation in the Middle East have added to the glitter of gold and made it a major investment beneficiary besides local stock exchange markets and real state," Barakat said. Internationally, gold demand has also increased in India — the largest gold consumer market in the world — to reach 17 percent in terms of weight in 2005 (equivalent to 25 percent increase in terms of dollar value). Likewise, China too has recorded an increase in demand.

On the other hand, there was an exception in Europe where gold demand growth was negative for many economic reasons.

As for the United States, which ranks second largest in terms of gold demand in the world, the demand increased in 2005 for the first time since 2001 despite high-energy prices and the two large hurricanes lashing the country in Q4.